Voluntary Car Repossession: The "Best Worst Option" When You Can't Pay

by AutoExpert | 25 June, 2025

Life happens. Job loss, medical bills, divorce – suddenly those car payments that seemed manageable are crushing someone's budget. When people can't afford their car anymore, they've got two choices: wait for the repo man to show up at 6 AM, or take control and surrender the car themselves.

That second option? It's called voluntary repossession, and while it's not exactly fun, it beats having someone come snatch the car from the driveway.

How Voluntary Repo Actually Works

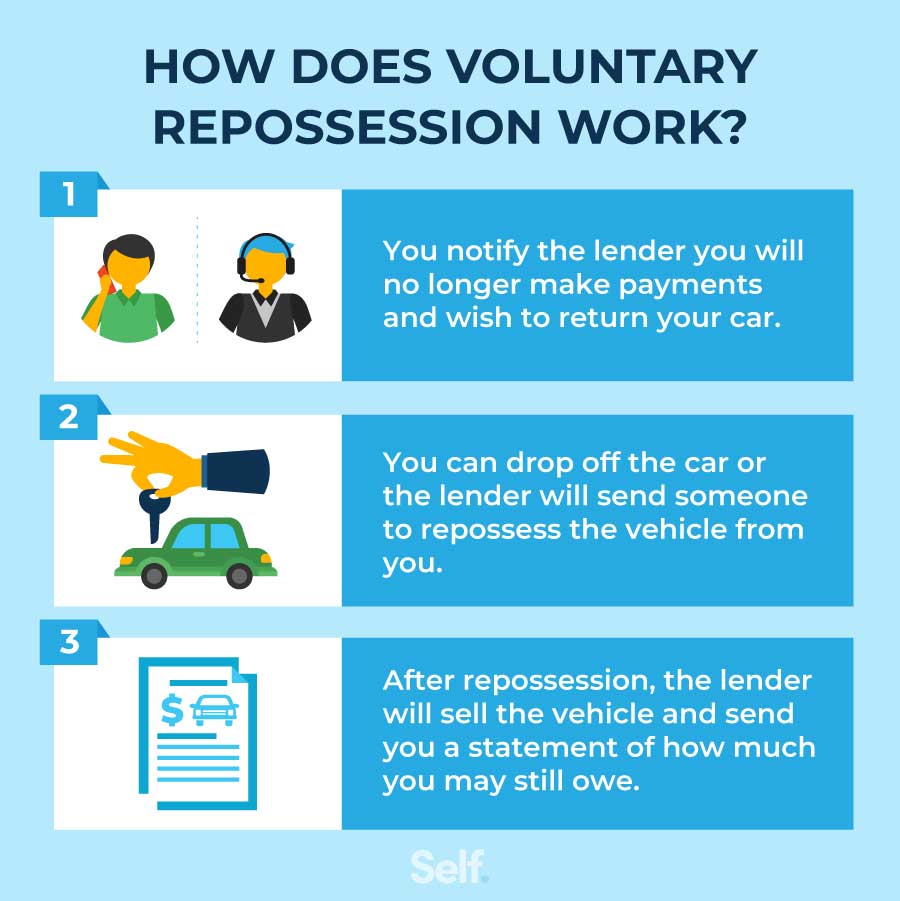

The process is pretty straightforward, though it feels anything but simple when someone's going through it. First step is calling the lender and basically saying "I can't do this anymore." Most banks have dealt with this before – they'll walk people through what happens next.

Usually, they'll want the car dropped off somewhere specific, like the original dealership. Before handing over the keys, smart folks clean out every last receipt, phone charger, and forgotten french fry from under the seats. Once that car's gone, it's gone.

Then comes the paperwork – a surrender agreement that makes everything official. After that, the bank sells the car, usually at auction for way less than anyone hopes.

The Part Nobody Talks About

Here's where things get ugly. Just because someone gives back the car doesn't mean the debt disappears. If the car sells for less than what's still owed on the loan (and it usually does), that leftover amount – called a deficiency balance – is still the borrower's problem.

So someone might surrender a car they owe $15,000 on, the bank sells it for $8,000, and now there's still $7,000 hanging over their head. The bank can absolutely come after that money, sometimes through collection agencies or even lawsuits.

Credit Score Carnage

Voluntary repo definitely beats forced repo, but it's still going to wreck someone's credit. The missed payments leading up to it, the default itself – it all gets reported and stays there for years. Future lenders see that stuff and think "risky borrower."

The credit hit can make getting another car loan brutal, with sky-high interest rates if anyone even approves the loan at all.

The Tax Surprise

Here's something that catches people off guard – the IRS might consider forgiven debt as income. If the bank eventually writes off that deficiency balance, someone could get a 1099-C form and owe taxes on money they never actually received. It's like getting kicked while already down.

Better Than the Alternative

Even with all the downsides, voluntary repo beats forced repo hands down. No tow truck showing up at work, no neighbors gossiping, no random 5 AM wake-up calls. People get to maintain some dignity and control over a crappy situation.

Plus, there's sometimes room to negotiate. Maybe the bank waives some fees or works out a payment plan for that deficiency balance. Can't do that when they're already loading the car onto a flatbed.

Last Resort Territory

Nobody should jump straight to voluntary repo without exploring other options first. Refinancing, loan modifications, or just selling the car privately might work better. Sometimes banks will work with people who communicate early instead of just disappearing.

But when those options are exhausted and the payments truly aren't manageable anymore, voluntary surrender beats letting things spiral completely out of control. It's damage control, not a solution, but sometimes that's all someone's got.