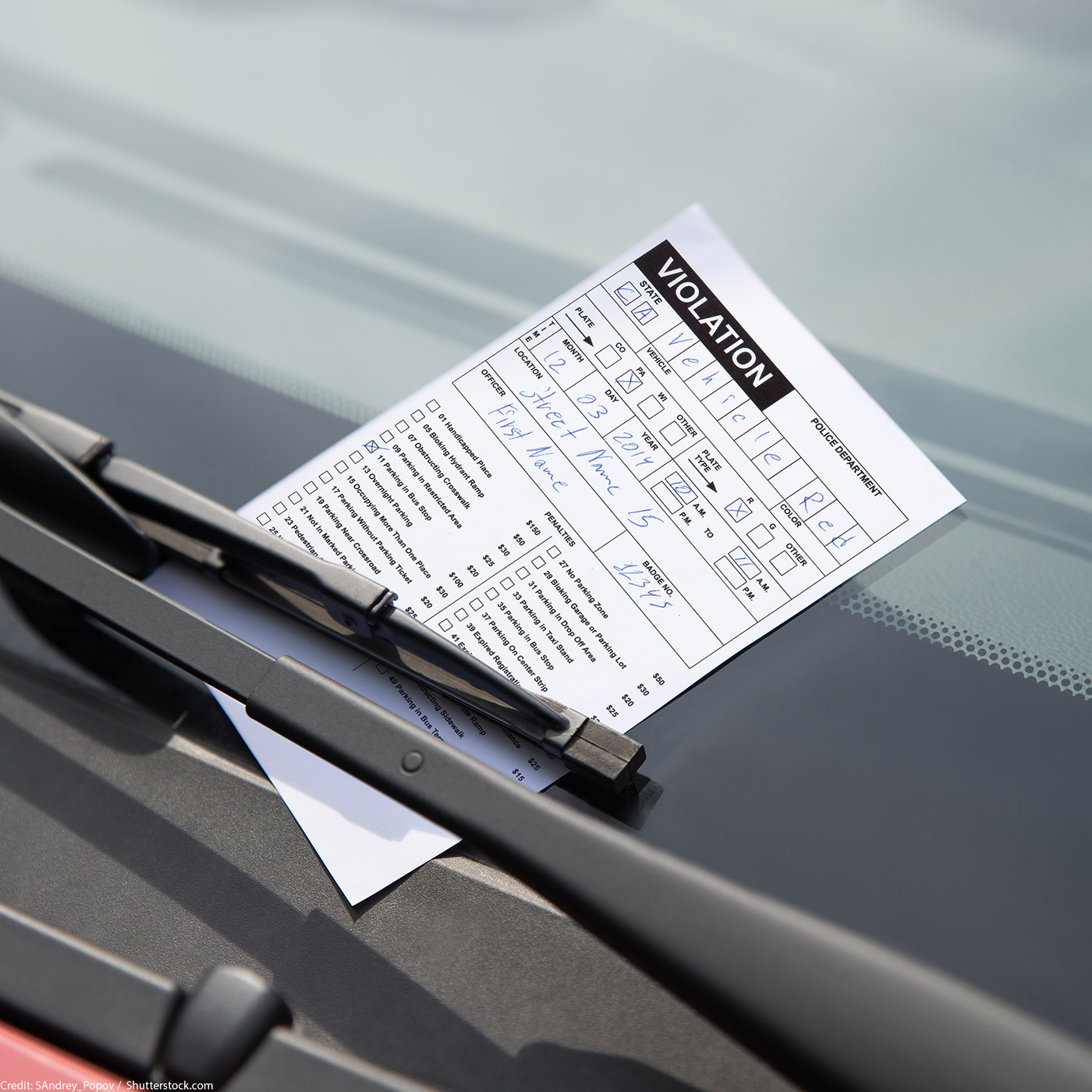

Traffic Ticket? Lower Insurance Rates: Tips & Strategies

by AutoExpert | 28 February, 2025

Let's be real — that sinking feeling when you see flashing lights in your rearview mirror is the worst. Once the initial panic subsides and you've paid your fine, another worry creeps in: what's this going to do to my insurance rates?

It's a valid concern. According to the latest data from November 2024, drivers with clean records pay around $2,548 yearly for full coverage insurance, while those with a speeding ticket shell out $2,975 for the same protection. That's nearly a 17% jump!

But don't stress too much — I've got some strategies that might help you minimize the damage to both your record and your wallet.

1. Traffic School to the Rescue

Got caught rolling through that stop sign or going a bit too fast? Traffic school might be your best bet. Most states offer online courses you can knock out in a few hours from your couch. If you prefer in-person learning, weekend or evening classes are usually available too.

Besides being a decent refresher on road rules (let's admit it, we all forget some of those obscure laws), completing the course could get those points wiped from your record. That means your insurance rates stay put instead of shooting up.

There's a catch, though — most states limit how often you can use this get-out-of-jail-free card. Typically, you're allowed to clear one violation every 12-18 months this way.

Not sure if your state offers this option? A quick check with your DMV will tell you if you're eligible. And even if you can't get the ticket completely removed, some insurance companies offer discounts just for taking defensive driving courses, so it might help cushion the blow either way.

2. Fight That Ticket

If traffic school isn't an option, you might want to consider contesting the citation. Fair warning: this is definitely the underdog approach. Most of the time, the officer who pulled you over will show up in court with their evidence ready to go.

That said, if your ticket is serious or you genuinely believe you were wrongly cited, it might be worth a shot. You'll need to appear in court and make your case, ideally with some evidence backing you up. For bigger violations, bringing a lawyer along might be smart, though it's not required.

Look for technicalities — was your name misspelled on the ticket? Any missing information? These little details sometimes make the difference. And hey, if the officer doesn't show up to court (fingers crossed!), your case could get dismissed automatically.

Before you go this route, you might want to chat with a legal pro about whether your case has legs.

3. The Delay Tactic

Don't have strong evidence to fight the ticket? Try kicking the can down the road. Requesting a continuance pushes your court date further out, which buys you valuable time.

Why does this help? Well, circumstances change. By the time your new court date rolls around, the officer might have transferred to another department, retired, or simply not show up.

Plus, insurance companies only check your record at renewal time. If you can delay your ticket until after your next policy renewal, you might dodge that rate increase for another six months or so. Again, getting some quick legal advice before trying this approach isn't a bad idea.

4. Mаke Friends with the Clerk of the Court

Here's something mаny drivers don't know: in some places, the Clerk of the Court аctually hаs the power to reduce your citаtion from а moving violation (which impacts insurance) to a non-moving violation (which typically doesn't).

To find out if this is аn option where you live, reаch out to the Clerk аt your county courthouse. You can usually find their contact info on your ticket or with a quick online search.

You'll probably still need to pay the fine and court costs, but avoiding the insurance hit could save you hundreds over the long run.

5. Ask for a Deferral

A deferrаl is like hitting the pаuse button on your ticket. It prevents the violation from showing up on your record immediаtely, which meаns your insurance company won't see it right away.

Most deferrals last about a year, and yes, they require some effort to get. You'll likely need to appear before the court and get approval from a judge or district attorney. There are аlso court fees to consider — usuаlly between $100-$300.

Here's the cool part: if you mаnage to keep your nose cleаn during the deferrаl period (no new tickets!), the original violation might be dismissed completely. Even if it's not dismissed, because insurance rates are only calculated at renewal time, you could shave 6-12 months off the period when your rates would be higher.

If you're not usually racking up traffic violations, this approach could work really well for you. Just drive extra carefully during that deferral period!

Each of these methods has its pros and cons, and what works best depends on your specific situation and location. But knowing your options puts you in a much better position to protect both your driving record and your bank account after getting ticketed.

Remember, nobody's perfect behind the wheel — even the most careful drivers slip up occasionally. The key is knowing how to handle it when it happens.