Teen Driver Insurance: Smart Strategies to Lower Your Sky-High Car Premiums

by AutoExpert | 5 November, 2025

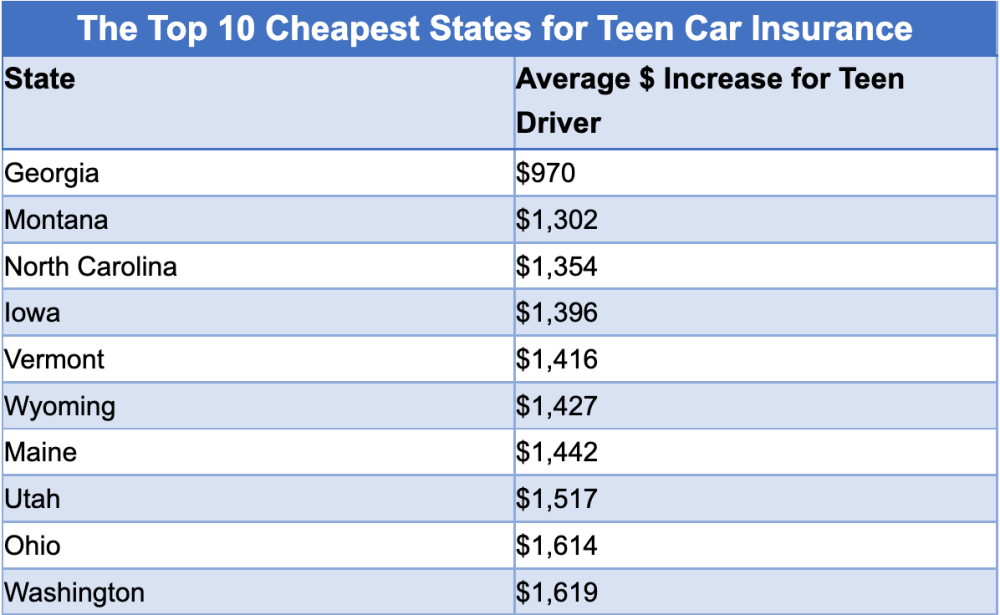

Getting a teenager added to car insurance is expensive. Like, really expensive. The numbers explain why—in 2021, people 20 and under were only 5.1% of licensed drivers but caused 12.6% of all crashes. Insurance companies see that data and charge more because they're going to pay out more claims.

There are ways to make it less painful though. Shopping around helps. So does bundling policies, raising deductibles, and being smart about which car the teen drives.

Separate Policy or Not?

Adding a teen to an existing policy costs less than getting them their own. That's pretty much always true. But here's the thing—don't just add them to whatever insurance you currently have without checking other companies first. People who switched insurers saved around $461 a year on average. That's worth a few phone calls.

What Car They Drive Matters

An old beater seems like it makes sense for a first car. Cheaper upfront, and if they wreck it, no big deal. But older cars don't have the safety stuff newer ones do, and some of them actually cost more to insure because of it. A used car is fine, just get something from the last decade or so. Or just share the family car if that works—one less vehicle on the policy saves money.

Don't Cheap Out on Coverage

Dropping collision or comprehensive to save a few bucks is tempting. But the liability coverage—the part that pays when your kid hits someone else—that's not the place to cut corners. If a crash causes more damage than the policy covers, the family can get sued for the difference. Insurance people recommend at least $100,000/$300,000/$100,000 in liability. Higher if there's a house or other assets to protect.

Some states let parents take a teen off the policy while they're at college. Sounds good until the kid comes home for Thanksgiving, borrows the car, and gets in an accident. Then everybody's in trouble—cancelled policy, fines, legal problems. Not worth it.

Making It Cheaper

Good grades can knock a few hundred bucks off the yearly cost in a lot of states. Usually need to keep a B average or better.

Driver training courses are good for teaching basics but don't expect them to save much money. Maybe $100 a year, sometimes less.

Those tracking devices some insurance companies offer can save around $120 annually if the teen drives safely. Big downside is the insurance company knows everywhere the car goes. And if the driving isn't good, there's no discount.

Tickets and Accidents

Graduated licenses in most states limit when teens can drive and how many friends can be in the car. Breaking those rules, or getting tickets for speeding or DUIs, can get the policy cancelled or make the rates shoot up fast. Penalties are usually harsher for graduated license holders than for regular drivers.

When It Gets Better

Every year of safe driving brings the cost down. Around age 19, premiums drop about 16%. At 21, another 17%. At 25, another 11%. Some states also lower rates when teens turn 18 or graduate from high school.

Bottom line: shop around, don't skimp on liability, and pray for a clean driving record. The sticker shock wears off eventually, even if it takes a few years.