Smart Car Loan Strategies: How to Get the Best Rate and Save Thousands

by AutoExpert | 4 November, 2025

Nobody wakes up excited about car loans, but messing this up can cost serious money. The good news? It's not that complicated once you know what to watch out for.

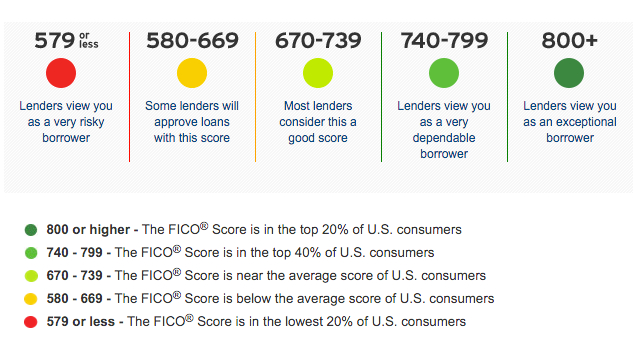

Credit Scores Matter (Obviously)

Better credit score, better interest rate. Pretty straightforward. Lenders look at someone's payment history and decide if they're trustworthy. Makes sense, right? Though weirdly enough, even people with decent credit end up overpaying sometimes because they don't bother comparing offers.

The smart move is checking credit reports a few months before car shopping starts. Gives time to handle any weird stuff that pops up. Experian gives out free scores, and so do most banks these days. For the detailed report, annualcreditreport.com has the goods.

Fixing Credit Problems Isn't Always Hard

Low score doesn't mean game over. Sometimes it's just mistakes on the report that take like two weeks to sort out. Knocking down some credit card debt helps too. Paying bills on time is boring but... yeah, it works.

Dealers Are Really Good at Their Job

Walking into a dealership without a budget is dangerous. Those salespeople are trained professionals who can talk anyone into upgrading to leather seats and a sunroof they don't need. Problem is, cars lose value fast while loan payments stick around forever, plus higher insurance costs and maybe local taxes on top.

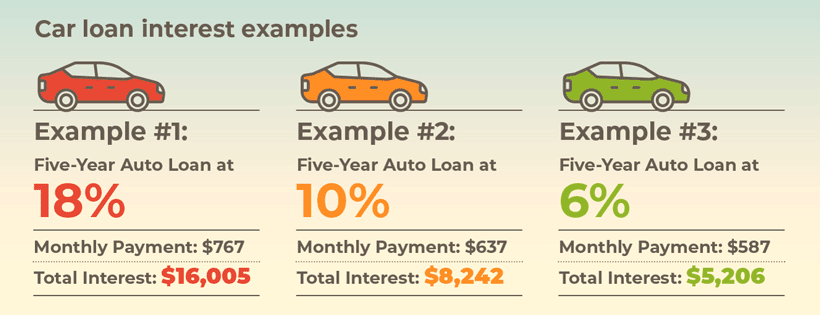

The Monthly Payment Trap

Dealers looove talking about monthly payments. "Only $350 a month!" sounds way better than discussing the total price. But here's the catch—lower monthly payments usually mean stretching the loan way longer. That means paying a ton more interest overall.

Quick example: Borrowing $30,000 at 6% over five years means paying around $580 monthly and roughly $4,800 in interest total. Stretch it to six years and the payment drops to $497, which feels better until realizing the interest total climbs to $5,780. That's an extra thousand bucks just to make the monthly number look nicer.

Oh, and longer loans mean higher odds of ending up "underwater"—owing more than the car's worth. That's a nightmare situation nobody wants.

Cash Up Front Saves Cash Later

Bigger down payment means borrowing less, which means paying less interest. Pretty simple math. Experts throw around numbers like 15% minimum, or 20-25% if possible. With interest rates being kinda rough lately, that upfront cash makes a real difference.

Get a Loan Lined Up First

Here's a trick: get preapproved by a bank or credit union before even looking at cars. Shows up to the dealership with a loan already in hand, which is basically having leverage. The dealer might beat that rate, might not, but at least there's something to compare against.

Spotty Credit? Check Manufacturer Deals

People with rough credit sometimes find special financing through car companies, though it's usually only on their basic models. Used cars mean smaller loans, but some lenders actually like financing new cars better because warranties mean fewer surprises down the road.

Credit unions often have better rates than dealerships, so hitting up a few different places before signing anything is worth the hassle.

Used Cars Are Cheaper (Duh)

Yeah, used car loan rates run higher, but borrowing way less money can still work out better overall. Just avoid the super sketchy used car lots, especially those places where they finance the car themselves. Those interest rates can be absolutely wild.

Some Ugly Truth About Discrimination

Research shows Black and Hispanic borrowers typically pay about a percentage point more in interest than white borrowers with identical credit. They also get denied more often. It's messed up. Anyone who thinks they got discriminated against can file complaints with the Consumer Financial Protection Bureau or FTC.

The Takeaway

Do some homework before shopping. Check credit, get preapproved somewhere, put down whatever's manageable, and don't fall for the "low monthly payment" pitch when it means paying for six or seven years. A little effort up front saves a bunch of money later. Worth it.