Car Dealership Tactics Exposed: How to Beat the Bait-and-Switch & Four Square Trap

by AutoExpert | 4 November, 2025

Most dealerships are fine, but some still pull the same old stunts they've been using for decades. The good news? Once you know the playbook, it's way easier to avoid getting ripped off.

Former car salespeople spilled the beans on their industry's favorite tactics, and yeah, some of it's pretty sneaky.

The Bait-and-Switch Price

That amazing online deal? It might not actually exist. Dealerships advertise cars at prices that are technically real but practically impossible to get. Show up and suddenly there's $10,000 worth of "dealer-added accessories" nobody asked for. Or that specific car just sold (shocker), but there's a pricier one available. Or the finance office marks up the interest rate and pockets the difference.

One former salesman who spent 43 years in the business says it starts before anyone even walks through the door. The advertised price gets people in, then the upselling begins.

Beating it: Before driving anywhere, call or email to confirm the car exists. Ask for the window sticker to see exactly what's included, then get an itemized out-the-door price with all taxes and fees spelled out. Negotiate everything over email first if possible—way harder for them to spring surprises when there's a paper trail. If they won't discuss numbers unless you show up in person, try a different dealer.

The Fake Urgency

"Three other people are looking at this car!" "This deal expires today!" Salespeople are trained to create panic so buyers make rushed decisions. For a while during the pandemic, that urgency was actually real—inventory was scarce and dealers could charge whatever they wanted. But those days are over. Cars are back on lots and buyers have leverage again.

A former dealer manager says this tactic is all about throwing people off balance right from the start.

Beating it: Slow everything down on purpose. Go for a test drive, express interest, then say something like "I need to think about this, let's continue over email." Set a time limit before walking in and stick to it, no matter what anyone says.

The Four Square Trap

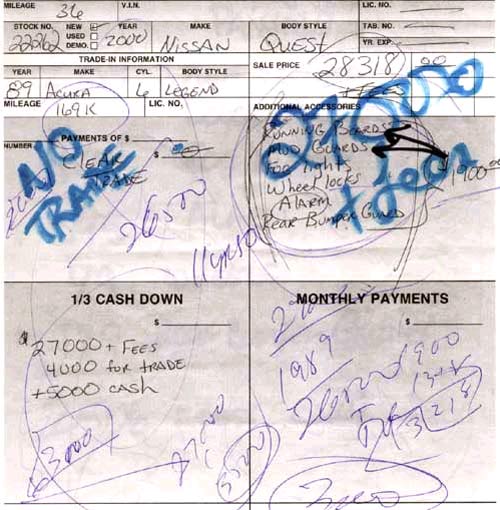

This is the big one. The salesperson pulls out a sheet of paper divided into four boxes—trade-in value, purchase price, down payment, and monthly payment. Looks simple enough, right? It's not.

The whole point is making everything as confusing as possible. They'll write in huge letters, flip the paper over, cross stuff out, scribble new numbers—anything to blur the lines between what's actually being negotiated. The goal is focusing on that monthly payment instead of the total cost.

Here's the trick: they can make the monthly payment look great by stretching the loan from three years to six. Sure, $400 a month sounds better than $600, but that longer loan means paying thousands more in interest overall.

Sometimes they'll ask buyers to initial something saying "I'll buy the car if we agree on numbers." One veteran salesman says that's purely a guilt tactic—legally meaningless, but it lets managers come back later with "Doesn't your word mean anything?" to pressure people into finishing the deal.

Beating it: Get preapproved for a loan before talking to any dealership. Negotiate the car's price separately from financing. Use a loan calculator on a phone to double-check their math—the Dallas Federal Reserve has a simple one that shows exactly what monthly payments should be based on the price, interest rate, and loan length. If their numbers don't match, something's wrong.

The Script They All Use

Ever notice how car salespeople say certain things the exact same way? That's because they're literally following scripts called "word tracks."

Examples: "What monthly budget were you thinking?" (moves focus away from total price). Or "Got it, $500—up to?" (trying to get buyers to increase their limit). Or "Were you planning on putting that much down or more?" (fishing for a bigger down payment).

There's also the classic "let's split the difference" move. Sounds fair, but meeting in the middle of a bad deal is still a bad deal.

Beating it: Have some counter-scripts ready. When they pivot to monthly payments, say "I'd rather focus on the overall cost." If numbers are too high, try "That's out of my budget." Not ready to commit? Just say "I'm not ready to purchase today." These simple phrases work surprisingly well.

The Good Cop/Bad Cop Routine

The friendly salesperson brings coffee and acts like they're on the buyer's side, then sends the manager out to play hardball. Or they'll say "I can get you a lower price, but only if you finance through us" or "but you have to buy the extended warranty." Classic quid pro quo stuff.

Beating it: Stay calm and speak their language. Many dealerships reward employees based on customer surveys, so mentioning "I'll give you all tens on the survey if this goes well" can actually help get them on your side.

And if nothing works? Just leave. Walking away is always an option.

Former salespeople say the simplest defense is also the most powerful: the word "no." Don't understand something? Say no. Feel pressured? Say no. It's two letters and it works every time.

The bottom line is dealerships have refined these tactics over decades, but they only work on people who don't see them coming. A little preparation—getting preapproved for a loan, negotiating over email, using a calculator to check their math—goes a long way. And remembering that walking away is always possible? That's the ultimate power move.