The Rise of Software-Defined Cars: Transforming Automotive Industry Standards

by AutoExpert | 8 April, 2025

The battle for automotive supremacy isn't about horsepower or fuel efficiency anymore. It's about code.

Tomorrow's cars won't just be machines that get you from A to B. They'll be adaptable platforms that improve over time, integrate with your digital life, and become increasingly personalized. It's potentially the biggest shift in automotive history.

But here's the catch: most car companies are struggling to make this transition.

"There are three companies in the world that have managed to [master software]: Tesla, Rivian and Volvo," according to former Volvo CEO Jim Rowan. "There's a lot of good car companies but none of them have figured it out."

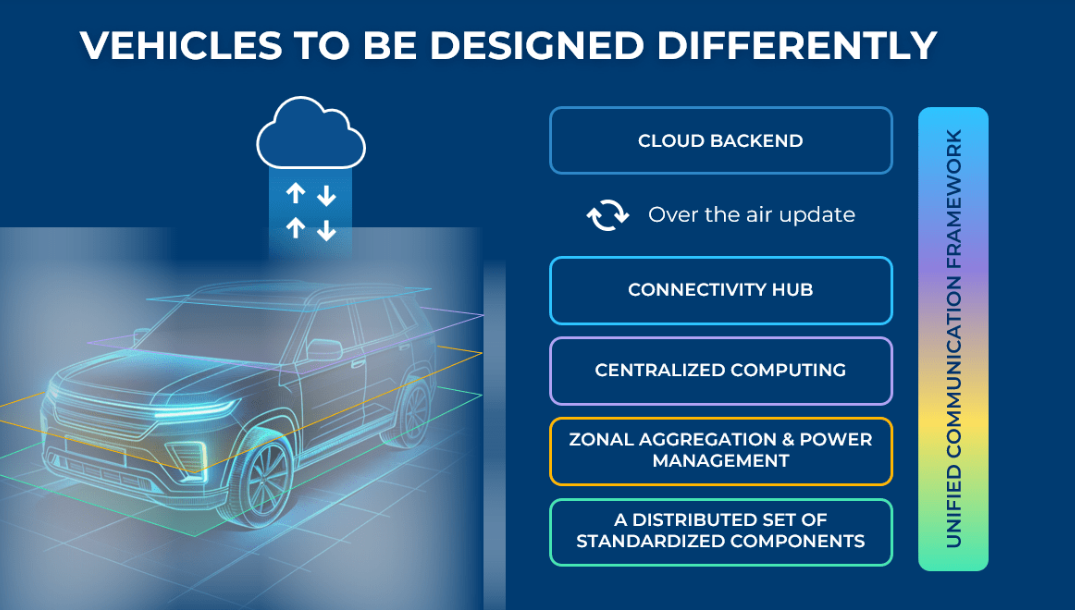

What makes a car "software-defined" isn't just having a fancy touchscreen. It's about designing the entire vehicle as a digital platform where key functions are controlled by software that can be updated remotely. Think less car, more rolling smartphone.

Tesla pioneered this approach out of necessity. Without access to traditional auto industry suppliers, they built their systems in-house. Chinese automakers and startups like Rivian followed suit, while traditional manufacturers are racing to catch up.

The advantages are significant. The original Model 3 shipped without auto high-beams, smart wipers, or even functional heated rear seats. All these features were added later through updates. This approach simplifies production, cuts costs, and lets the car improve long after purchase.

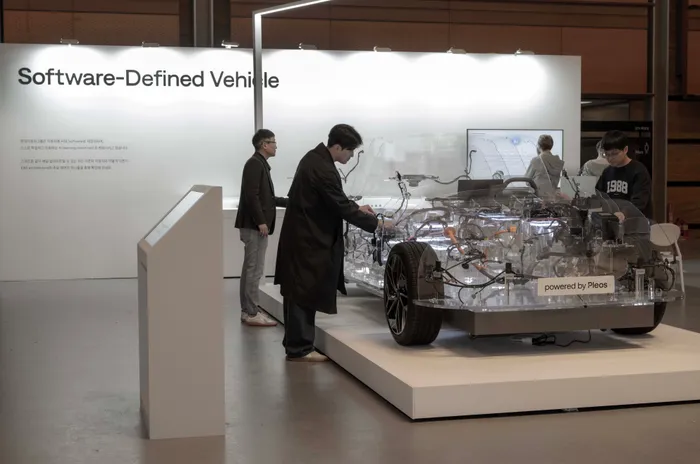

Newer automakers are also rethinking the vehicle's electronic architecture. Instead of dozens of separate control units handling specific tasks, companies like Rivian are moving to a "zonal architecture" with fewer, more centralized computers.

"We've reduced the harness lengths by 1.6 miles in the car with the same feature set," says Kyle Lobo, Rivian's Director of Electrical Architecture. The 2025 R1 models use just seven electronic control units—down from 17 in previous versions and far fewer than the 150 found in some luxury competitors. This cuts weight (by 44 pounds) and manufacturing complexity.

These innovations caught Volkswagen's attention. The German giant has struggled with software development, leading to delayed vehicles and executive turnover. Last November, VW announced a joint venture with Rivian to use the startup's software platform in future models like the ID.1.

The software revolution has broader implications too. Carmakers gain unprecedented access to user data and behavior. Tesla uses this to adjust insurance rates based on driving habits, rewarding safe driving but raising privacy concerns.

The shift also raises questions about long-term support and repairability. As cars become more like smartphones, will they be harder to service independently? What happens when a manufacturer stops supporting older models?

Legacy automakers aren't standing still. GM's Android Automotive systems show promise, while Volvo/Polestar and Toyota are planning major software pushes. But startups still have an edge.

"As a startup, we got to think differently from a traditional OEM, where we are not burdened with the choices that were already made," says Vivek Surya, Rivian's Director of Software Product Management.

The real question now is whether consumers will embrace this transformation as eagerly as the industry is pursuing it.