Personal Contract Purchase (PCP) Explained: Your Guide to Flexible Car Finance

by AutoExpert | 2 July, 2025

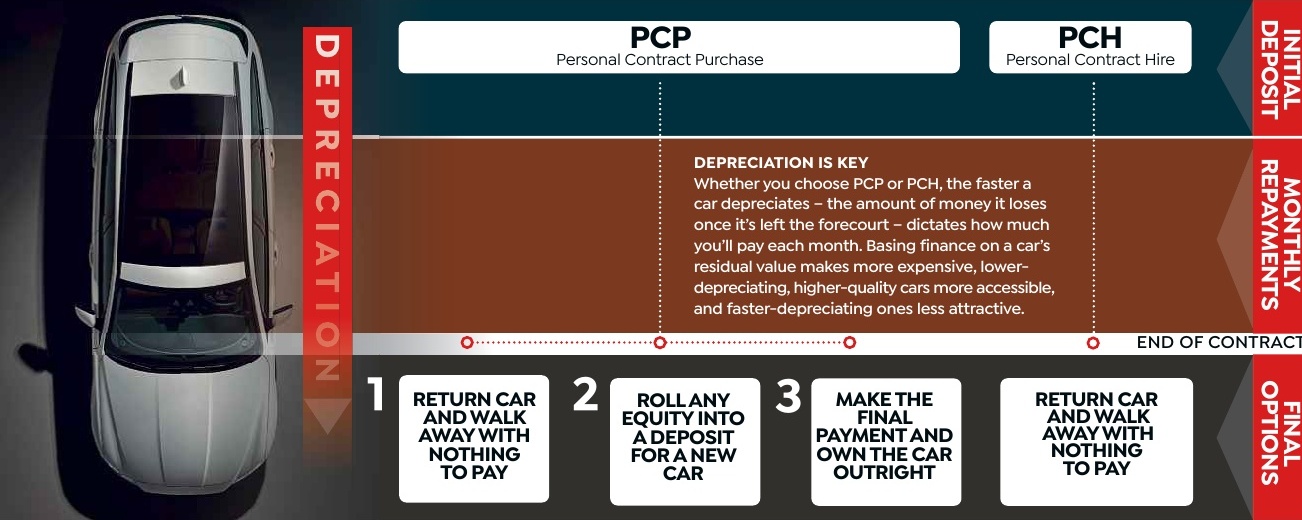

Getting a new car without breaking the bank? That's where Personal Contract Purchase (PCP) comes in. It's become huge in the UK because it lets people drive cars they probably couldn't afford otherwise, with way lower monthly payments than traditional loans.

The whole idea is pretty clever – you're not buying the entire car upfront. Instead, you're basically paying for the bit of value the car loses while you're driving it, plus some interest. Then at the end, you get to choose what happens next.

How This Whole Thing Actually Works

Think of PCP like renting a car's depreciation. Here's the breakdown:

- The Deposit Dance

Most deals want around 20% down, though you can sometimes get away with less. Put down more cash upfront, and your monthly payments shrink. Put down less, and you'll pay more each month. Pretty straightforward math.

- Monthly Payments That Don't Hurt

Here's where PCP gets interesting. The dealer figures out what the car will be worth at the end of your contract – that's called the Guaranteed Minimum Future Value (GMFV). You only pay for the difference between what the car costs now and what it'll be worth later, plus interest.

So if a $40,000 car will be worth $20,000 in three years, you're only financing that $20,000 difference (minus your deposit). Way easier on the wallet than financing the full price.

- Decision Time

When your contract's up, you've got three choices:

- Pay the GMFV and keep the car

- Hand back the keys and walk away (assuming you haven't trashed it or driven it into the ground)

- Trade it in for a new deal if the car's worth more than expected

PCP vs Leasing: Not the Same Thing

People mix these up all the time, but they're actually pretty different. With PCP, you can end up owning the car if you want. With leasing, you're basically long-term renting – the car goes back no matter what.

Leasing usually bundles in maintenance and service costs, which is nice if you don't want to think about that stuff. PCP leaves you handling insurance, repairs, and servicing yourself.

If you're the type who likes having options, PCP's probably better. If you just want to drive something new every few years without any hassle, leasing might be your thing.

The Good and the Not-So-Good

What's Great About PCP: Lower monthly payments mean you can probably afford a nicer car than you thought. Plus, you're protected from the car losing value faster than expected – that's the dealer's problem, not yours.

The flexibility is pretty sweet too. Don't like the car after a few years? Give it back. Love it? Buy it. Want something different? Trade up.

What's Not So Great: Those mileage limits can bite you. Go over them and you'll pay through the nose in penalties. And if you do decide to keep the car, that final balloon payment can be a real shock to the system.

Plus, any damage beyond normal wear and tear comes out of your pocket when you return it.

Don't Make These Rookie Mistakes

The biggest screwup people make is not understanding what that GMFV number really means. It's not just some random figure – it determines everything about your deal.

Being unrealistic about mileage is another classic mistake. If you drive 20,000 miles a year but sign up for a 10,000-mile limit because it's cheaper, you're gonna have a bad time.

And don't get so excited about low monthly payments that you ignore the interest rate. Shop around, compare the total cost, not just what you're paying each month.

Is PCP Right for You?

PCP works great if you like driving newer cars but don't want to commit to ownership right away. It's perfect for people who want lower payments and the flexibility to decide later what to do with the car.

But if you're someone who drives tons of miles, keeps cars forever, or just wants the simplest possible deal, traditional financing might make more sense.

The key is being honest about your driving habits and what you actually want from a car deal. PCP can be brilliant, but only if it actually fits your lifestyle.