Cost of a Speeding Ticket: Insurance Premiums Jump an Average of $524 Per Year

by AutoExpert | 18 November, 2025

Most drivers think of a speeding ticket as a quick hit to the wallet. Pay the fine, move on. But a new study from LendingTree shows there’s a lingering cost many people forget about: your insurance bill.

LendingTree looked at rates from major insurers using a sample driver — a 30-year-old man with a clean record, full coverage, and a 2018 Honda CR-V. Then they compared his premium before and after a ticket for driving 11–15 mph over the limit, one of the most common speeding violations.

The bad news: the average hike isn’t small

Nationwide, a single speeding ticket bumped insurance costs by an extra $524 a year — roughly $44 more every month. And in some states, the jump was much worse.

The states with the biggest spikes

According to the study, these states hand out the steepest increases after a driver’s first ticket:

California – premiums shoot up 42% (+$1,004/year)

Michigan – 35.8% increase

Nevada – 31.3% increase

Rounding out the top 10 were Rhode Island, Arkansas, Oregon, Arizona, Illinois, Pennsylvania, and Colorado.

Where the increases are smallest

A few states barely budged by comparison:

Florida – 12.4%

Texas – 12.5%

North Carolina & New York – 13.4% each

Still annoying, but not nearly as brutal as the West Coast.

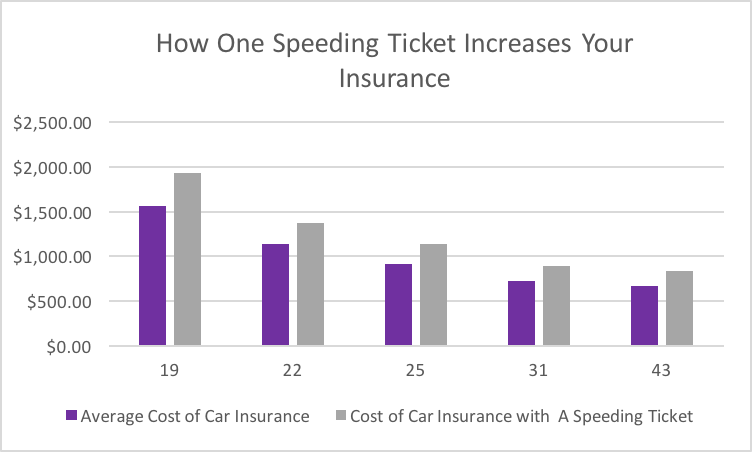

Why insurers crank up your rates

Insurance companies see a speeding ticket as a sign you’re more likely to get into a crash — which means they’re more likely to pay out. That risk gets priced into your premium in the form of a surcharge. Younger drivers get hit the hardest, with increases more than double what older drivers pay.

And don’t forget about points

In 40 states, speeding tickets also add points to your license. Stack up too many and your license can be suspended. The silver lining? Drivers can often take defensive driving courses or keep a clean record long enough for points (and premiums) to drop back down.

If avoiding tickets altogether sounds easier, there are apps that help warn you about speed traps — or you can stick to the states with the highest speed limits and spare yourself the insurance drama.